How to Get Started with DeFi

Hearing a lot of hype around DeFi and unsure where to get started? This guide is for you. We'll use the Solana blockchain to introduce you to the world of decentralized finance.

With less than $50 and an hour of your time, you'll learn:

1. How to set up and fund a crypto wallet

2. How to find liquidity pools to contribute to

3. How to monitor your DeFi investments over time

Intro: Welcome to Decentralized Finance

This beginner’s guide will walk you through your first investment into decentralized finance.

We’ll cover setting up the software you need, purchasing tokens, and investing them to earn high yields, which may vastly exceed the interest on your savings account.

This is a quick start guide, focused on making your first investment. We’ll also go over the basics of the risks you’re taking and how to mitigate them. For the purposes of this guide, we will use the Solana ecosystem.

Disclaimer: Nothing in this guide is legal or financial advice of any kind. It is important that you do your own research and make your own investment decisions.

Step 1: Wallet Setup

Introduction to Crypto Wallets

The first thing you’ll need to interact with decentralized finance is a wallet to hold your cryptocurrency tokens.

There are two main types of crypto wallets: hot wallets and cold wallets.

Hot wallets are used to easily connect to the internet. They’re useful to interact with decentralized finance products or to trade tokens. Hot wallets can be desktop software applications, mobile apps, or accessed through websites.

Cold wallets offer more security. They can be either physical pieces of paper containing the information necessary for accessing the cryptocurrency in the wallet, or physical devices from manufacturers such as Trezor or Ledger.

We will be using Phantom in this guide. Phantom is a user-friendly hot wallet built specifically for the Solana blockchain. It is available as an iOS app, but we’ll be using the Chrome extension in this guide. Phantom is one of the most popular Solana wallets available, with over two million daily active users. Its development is funded by top venture capital firms like Andreessen Horowitz, Solana Ventures, and Jump Capital.

Setting up Phantom

We’ll start by setting up the Phantom chrome extension, which you can find on the Chrome Web Store.

Follow the prompts to create a new wallet and password.

Write down your seed phrase on paper and save it somewhere secure. Alternatively, store the phrase in a password manager like 1Password or memorize the phrase. The seed phrase gives anyone who has it complete access to the wallet! Do not share it. Do not store the phrase in an unencrypted file on your computer.

At this point, you should be set up with an empty Solana wallet.

Feel free to scroll through some of the supported tokens by clicking “Manage token list.”

Step 2: Purchasing Tokens on a Centralized Exchange

The next step is to purchase tokens and send them to your newly created hot wallet.

To do so, we’ll use a centralized exchange. Centralized exchanges allow the exchange of fiat currency (like U.S. dollars) for cryptocurrency tokens. We recommend U.S. users use Coinbase.

Navigate to coinbase.com and sign up for an account. You’ll need to verify your email and phone number, and add your personal information. Additionally, follow the steps to verify your identity and link a payment method as prompted. Coinbase lists each step in the account creation process on their website.

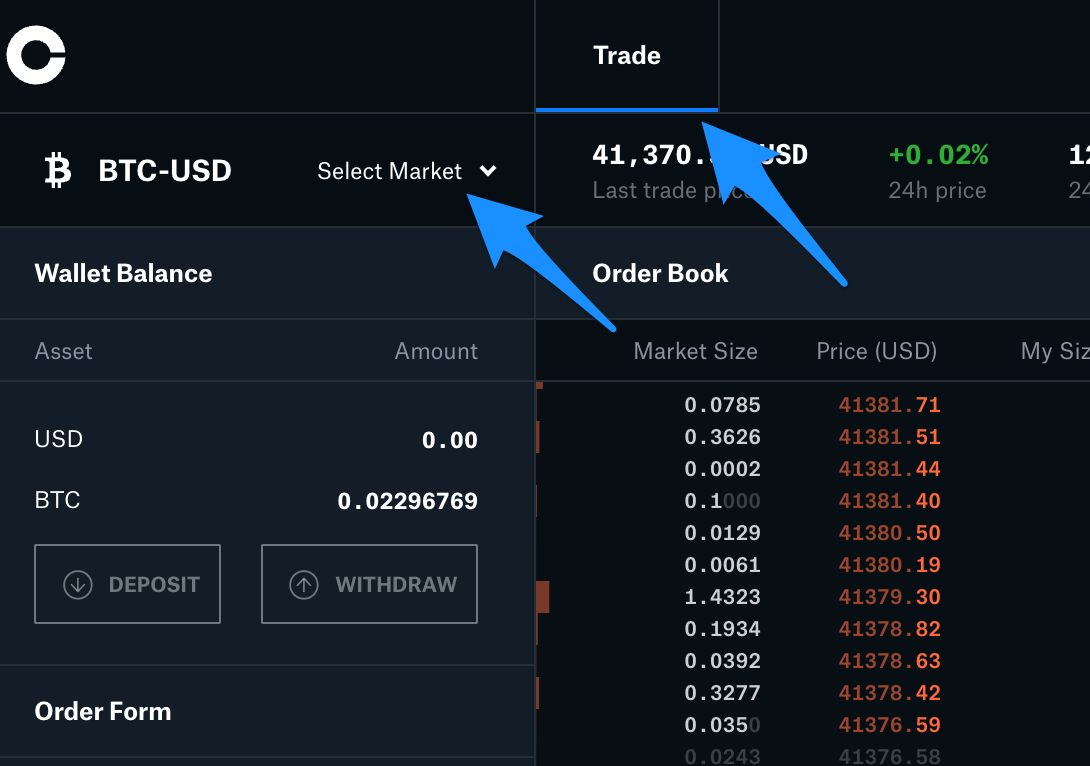

Once your account is set up, navigate to Coinbase Pro at pro.coinbase.com.

Coinbase Pro enables advanced trading features and has lower fees than Coinbase’s standard website. You’ll be able to log in with the Coinbase account you set up.

Navigate to the SOL-USD pair, and place a buy order. This is purchasing the SOL token of the Solana blockchain with USD. We’ll use the SOL tokens later when we interact with DeFi.

Add USD funds to your account if necessary. We recommend purchasing only a small amount of SOL to get started.

Finally, press the withdraw button to send your SOL tokens to your newly created wallet. Select SOL from the list of your tokens, and withdraw to a crypto address.

The address of your Solana wallet address is at the top of the Phantom extension - make sure you paste it into Coinbase exactly.

Within a few moments, you should see the balance in Phantom updated to include your newly purchased SOL tokens!

If the transaction hasn't gone through after a few hours, and you sent it to the correct wallet address, there may be a Coinbase error that requires you to re-initiate the withdrawal.

Step 3: Find a Liquidity Pool

Ways to Accrue Interest with DeFi

Single-sided staking

Some protocols allow you to stake the tokens for that protocol. This allows you to accrue interest on your tokens coming from the rewards of the protocol. It also often gives you governance rights to vote on updates to the protocol.

Liquidity Pools

A liquidity pool is a collection of tokens. Liquidity pools are used by decentralized exchanges to enable the swapping of tokens at market rate. For instance, you could swap between the SOL token of the Solana blockchain and the USDC token, which is a “stablecoin” pegged to be worth $1 USD. You are able to deposit money into the pool as a liquidity provider. As a reward for storing your tokens in the pool, you will receive a portion of exchange fees that are accrued each time a swap is made in that pool on the exchange.

Risks of Participating in DeFi

Divergence Loss

Divergence loss, also known as impermanent loss, is a key risk involved with being a liquidity provider. Divergence loss occurs when the values of the tokens within the pool change compared to the value of the tokens when you deposit them. The larger the change in value, the larger the divergence loss you experience.

Divergence loss occurs because the price of swapping tokens within a pool is determined by the ratio of the assets in the pool. When you withdraw funds from a liquidity pool, if the ratio between tokens in the pool has changed, the ratio of tokens you withdraw will be different from that which you deposited.

Note that the interest you receive from providing liquidity may offset the loss of value due to divergence loss.

Smart Contract Risk

Decentralized finance relies on smart contracts, which are computer programs stored on the blockchain. Funds may be lost due to a bug in a smart contract or a hack or exploit of the smart contracts related to the liquidity pool.

Raydium

Raydium is a popular decentralized exchange on Solana.

To use Raydium, click "Launch app," and then click "Connect Wallet" to connect your Phantom wallet.

Next, browse the pools on Raydium.

When selecting a pool, consider the following factors:

- Volume - Higher volume yields more profits

- Liquidity - Pools with less liquidity may be more susceptible to price slippage, and thus at greater risk of divergence loss

- Volume / Liquidity - Understanding how this ratio changes over time can help you anticipate the APY you will receive from the pool. With a decreasing ratio, you would earn less in fees over time for providing liquidity

- Price divergence of tokens - Positively correlated token pair valuations are less likely to experience divergence loss

Step 4. Supplying Liquidity

In the below example, we will supply liquidity to the SOL-USDC pool, with an estimated 14.05% APR.

First, swap so that you have equal amounts of each of the tokens you would like to contribute to the pool. Pools generally require contributing a 50:50 ratio of tokens. You can do this at https://raydium.io/swap/.

Approve the transaction in your wallet.

You should see the USDC tokens in your Phantom wallet.

Next, click the liquidity button. This will let you add equal value amounts of SOL and USDC to the liquidity pool. Be sure to read Raydium's Liquidity Guide before submitting the transaction to understand the risks involved.

Approve the transaction.

Finally, go to https://raydium.io/farms/ to stake your LP token. Search for the SOL-USDC LP. Here, we’re getting 23.39% APR. Click "start farming" and stake the max amount of LP tokens.

Approve the transaction.

If you do not have LP tokens to stake, then there was an error in the previous step, or the staking transaction has not completed yet.

Click "show staked" in the top right to confirm that you succeeded in staking your LP tokens, and you'll see the amount deposited when you click on the SOL-USDC LP farm. If you see the amount deposited, congratulation! You're now earning rewards. They will begin to accrue within a few minutes, and can be redeemed by clicking "Harvest."

Step 5. Tracking Your Portfolio

Step Finance is a useful dashboard to monitor your DeFi portfolio on Solana. Click "see portfolio," and after connecting your wallet, you'll see a dashboard of your assets, net worth, and yield farming. It may take some time for the Raydium farming to appear. Once it does, you'll be able to track your net worth over time.

Step 6. Optimizing

Yield aggregators can help you optimize your returns when participating in DeFi.

For example, Tulip supports the following strategies:

- Lending: “Deposit your tokens into Tulip's wide variety of lending pools with variable APY based on utilization of the pools.”

- Leveraged yield farming: “Utilize up to 3x leverage on LP pairs to yield farm. Tulip also offers features such as dual borrow which allows for strategies such as pseudo delta neutral farming within a single position.“

- Auto Vaults: “Tulip Auto Vaults auto-compounds LP farms, swapping the token emissions into more LP every 10 minutes to add to your balance. This provides a higher return due to the high compounding frequency.“

- Strategy Vaults: “Deposit single asset tokens into Tulip's strategic vaults and gain exposure to multiple yield farming strategies with a single deposit, no management required.“ (e.g. 62.31% APY)

Step 6. Cashing Out

To remove assets from Raydium, harvest your LP rewards.

Click the "-" button to unstake LP. Determine how much to unstake, or unstake the max amount.

Go to Pools, click "show staked," and click the "-" button to remove liquidity. You can remove the max amount.

After the transaction is confirmed, SOL and USDC tokens will appear in your Phantom wallet.

From there, you can send the tokens back to your Coinbase address if you like.

In pro.coinbase.com/portfolios, click "Deposit," and select the token to receive. Select "Crypto Address."

You'll see the address for your Coinbase wallet.

Within Phantom, click "Send," select the token, and send the token to the Coinbase wallet address. Be sure that you have the correct Coinbase wallet address, and that it is associated with the token you would like to send. You may wish to send a small amount at first to ensure the address is correct.

Appendix

A. Other Networks

It is possible to participate in DeFi on many different blockchains. In addition to Raydium on Solana, popular exchanges include Uniswap on the Ethereum blockchain, SpookySwap on Fantom, Trader Joe on Avalanche, and PancakeSwap on the BNB Smart Chain. Each network has many other exchanges as well, with different benefits and downsides.

You can use https://defillama.com/ to compare protocols.

B. Block explorers

You can view your transaction history, and all transactions that happen on Solana, on https://explorer.solana.com/

C. Final Notes

Remember that cryptocurrency token valuations can be volatile. Be careful when investing, and be sure to purchase only reputable tokens and vet liquidity pools and exchanges for legitimacy.